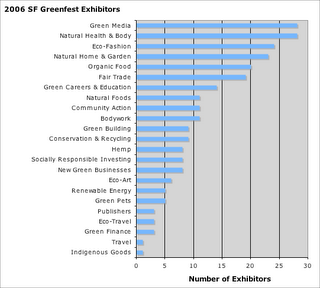

Walking around the recent SF

Green Festival (Greenfest), I was struck by the number and variety of exhibitors. The festival keeps growing, and this year, the

Concourse really felt crowded. Who were the exhibitors? The resulting analysis is based on data from the festival's own

listings, which I supplemented with descriptions from the exhibitors' web sites. I was interested in uncovering the common "themes or topics" in this year's festival.

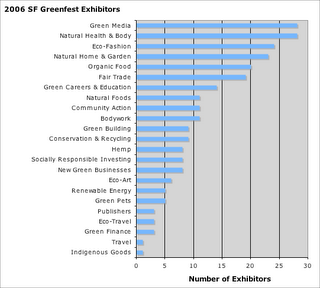

First some simple counts: there were 236 exhibitors across 23 categories, with some exhibitors listed in more than one category:

The graph confirms my experience while walking around the festival: there were a lot of publishers, clothing, and health and beauty products. It was a San Francisco festival, so it is not a surprise that most of the exhibitors were from California:

Most of the exhibitors were from the West Coast: California (148), Oregon (17), and Washington (12). Within California, San Francisco (45) and Alameda (31) counties were dominant:

If I were an organizer, I would try to increase the number of exhibitors from the Peninsula (San Mateo and Santa Clara), and help nurture Green Entrepreneurs in those nearby counties. Having more exhibitors from the Peninsula would also increase attendance from Silicon Valley.

Topics and ThemesThe Festival was ground zero for the

LOHAS Industry (Lifestyles of Health and Sustainability): I was interested in how companies appeal to members of this growing space. I decided to use Exhibitors' own company statements/descriptions/philosophies to see if there were any dominant themes and topics. If one wants to understand this segment, one might as well understand how the Green Entrepreneurs position themselves in the marketplace!

Using

recent developments in (unsupervised) machine learning and bayesian computation, an analyst can now analyze text data to uncover latent topics. I started with the

descriptions provided by the exhibitors, and supplemented it with descriptions from an exhibitor's own web site, whenever I felt that I needed a longer "mission or product statement". Using a text mining algorithm, I uncovered

25 themes/topics from the exhibitors' "mission or product statements". An interesting output of the algorithm, is that any individual "mission or product statement" can cover one or more topics. As an example, a Fair Trade coffee maker can talk about Fair Trade, the environment, and organic agriculture. Finally, one can measure the relative size of the different topics:

"making the world a better place" and "nutrition & organic foods" were the two most common topics discussed: if one were to examine the "missions & product statements" of the 200+ exhibitors, these are the two most commonly mentioned subjects. The one caveat about the size of topics: size is measured by the amount of text devoted to a topic. In the course of supplementing text for certain exhibitors, I may have inadvertently added to the size of certain topics. I suspect that's what happened in the case of "socially responsible finance".

ConclusionThe SF Green Festival continues to grow, and this year included 236 participating exhibitors. Since the conference was held in SF, most of the exhibitors came from the West Coast. Among California exhibitors, SF and Alameda county were dominant. For 2007, I recommend the festival organizers try to recruit more exhibitors from nearby San Mateo and Santa Clara counties.

Using a text mining algorithm, we studied themes and topics used in the exhibitors "mission and product statements". A similar and more thorough analysis may be useful to marketers in the

fast-growing LOHAS Industry (Lifestyles of Health and Sustainability).