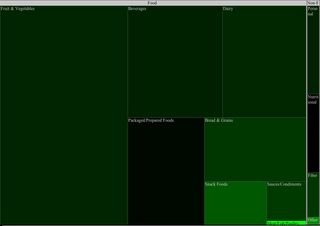

So what are the healthiest regions int the U.S.? The United Health Foundation conducted a study in 2004, where they measured states along several variables and ranked them using a composite index. To visualize the results, I took the data and generated a heat map. Green signifies a State scored higher than the 50 State average, Red signifies the State scored lower, Black means the State scored about the same as the 50 State average. (To enlarge a particular image, click on it.)

MN finished first: a position it has held 9 out of the last 15 years. NH, VT, HI and UT roundup the top five states. States in the Southeast consistently scored below the 50 State average. I have heard factoids that the Southern states lag the rest of the country in terms of income levels. But I have to admit the map still surpised me. These red colored states await Green Entrepreneurs and solutions.

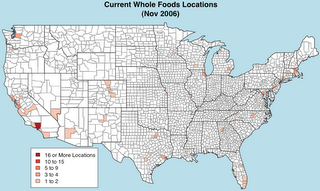

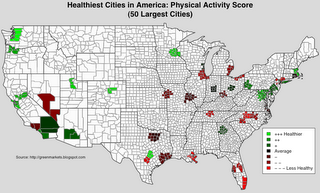

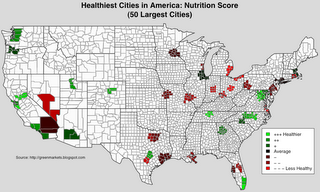

MN finished first: a position it has held 9 out of the last 15 years. NH, VT, HI and UT roundup the top five states. States in the Southeast consistently scored below the 50 State average. I have heard factoids that the Southern states lag the rest of the country in terms of income levels. But I have to admit the map still surpised me. These red colored states await Green Entrepreneurs and solutions.I wanted to "drill-down" into major cities in each state, but alas, I was unable to find data at the city level. Wanting "city-level" data, I decided to look at this ranking of the 50 largest U.S. cities, put together by a different organization (Centrum). Actually, Centrum ranked Metro Areas (or SMSA's), and they used the 2003 estimated population to come up with the 50 largest. Just like any "ranking" or "survey", this one has it's flaws, but Centrum was quite transparent about the data sources and metrics used in the study. The data came from mostly public sources. In coloring a specific Metro Area, I included counties that are part of the Metro Area: in some instances this might show Metro Areas crossing state lines.

The Overall Score and Ranking, is based on a weighted composite scores across several dimensions. (To enlarge a particular image, click on it. Feel free to use these maps.)

I thought the scores in the individual dimensions were interesting. For each dimension, the average score is equal to the (percentile) median: 50.

Mental Wellness was based on the following criteria.

I see that the West Coast is a prime market for stress relief solutions. Washington, DC scored the highest -- but they mean the residents of DC and not Congress!

Lifestyle Pursuits was based on the following criteria.

One can argue with the choice of "lifestyle pursuits" calling into question the stability of the results: different "lifestyle pursuits" would probably result in a very different map.

Physical Activity was based on the following criteria.

L.A. and South Florida finished lower than I expected: that blows our beach culture stereotype. Miami finished near the bottom. If they included Yoga, L.A. would be bright green!

Health Status was based on the following criteria.

These results seem to coincide somewhat with the State rankings above. Michigan which has finished #1 in the Unite Health rankings for 9 out of the last 15 years, is represented by Detroit, which is near the top in this metric.

Nutrition was based on the following criteria.

The Northern states fared poorly, possibly due to higher alcohol consumption and lack of year-round access to fresh fruits and vegetables.

Summary: The non-profit United Health Foundation's State Health rankings reveals opportunities for Green Entrepreneurs and activists based in the Southeastern states. Drilling-down to Metro Areas, I was unable to find city-level data from United Health, and turned to Metro Area rankings from a separate study.